What Does Home Insurance Agent In Jefferson Ga Mean?

Wiki Article

The Main Principles Of Auto Insurance Agent In Jefferson Ga

Table of ContentsUnknown Facts About Business Insurance Agent In Jefferson GaLife Insurance Agent In Jefferson Ga Things To Know Before You BuyThe 9-Minute Rule for Business Insurance Agent In Jefferson GaUnknown Facts About Home Insurance Agent In Jefferson Ga

, the typical yearly expense for an auto insurance coverage plan in the United States in 2016 was $935. Insurance policy likewise aids you stay clear of the devaluation of your car.The insurance coverage safeguards you and helps you with insurance claims that others make against you in crashes. The NCB may be provided as a price cut on the premium, making cars and truck insurance coverage extra budget-friendly (Insurance Agent in Jefferson GA).

A number of factors impact the costs: Age of the lorry: Oftentimes, an older automobile prices less to insure compared to a newer one. New vehicles have a greater market worth, so they set you back more to repair or change.

Particular lorries routinely make the frequently taken listings, so you may have to pay a higher premium if you have one of these. When it comes to vehicle insurance coverage, the three major kinds of policies are obligation, crash, and comprehensive.

Insurance Agent In Jefferson Ga Can Be Fun For Everyone

Some states call for vehicle drivers to carry this protection (https://www.abnewswire.com/companyname/www.jonfromalfa.com_124428.html#detail-tab). Underinsured driver. Comparable to without insurance coverage, this plan covers damages or injuries you endure from a driver that doesn't carry adequate protection. Motorcycle insurance coverage: This is a plan specifically for bikes because vehicle insurance doesn't cover motorcycle mishaps. The benefits of cars and truck insurance much outweigh the dangers as you could finish up paying thousands of dollars out-of-pocket for an accident you trigger.It's usually better to have even more protection than inadequate.

The Social Protection and Supplemental Safety Revenue special needs programs are the largest of several Federal programs that offer support to individuals with impairments (Auto Insurance Agent in Jefferson GA). While these two programs are different in lots of means, both are administered by the Social Security Administration and only individuals that have a disability and fulfill clinical standards may get advantages under either program

Make use of the Advantages Eligibility Testing Tool to learn which programs may have the ability to pay you advantages. If your application has actually lately been rejected, the Internet Allure is a starting indicate request an evaluation of our choice regarding your qualification for disability advantages. If your application is rejected for: Medical factors, you can finish and our website submit the Appeal Request and Appeal Impairment Report online. A succeeding evaluation of employees' payment claims and the degree to which absence, spirits and working with excellent workers were problems at these firms reveals the positive impacts of providing health and wellness insurance. When compared to businesses that did not offer health insurance coverage, it appears that using emphasis led to improvements in the ability to employ good employees, reductions in the number of employees' payment insurance claims and decreases in the degree to which absenteeism and performance were troubles for FOCUS businesses.

Business Insurance Agent In Jefferson Ga Things To Know Before You Get This

6 reports have actually been launched, including "Care Without Coverage: Too Little, Too Late," which discovers that working-age Americans without medical insurance are most likely to obtain also little treatment and get it far too late, be sicker and die quicker and get poorer treatment when they remain in the health center, also for severe circumstances like an electric motor automobile accident.The research study authors likewise note that broadening insurance coverage would likely lead to an increase in real source expense (no matter that pays), since the without insurance obtain about half as much clinical treatment as the privately guaranteed. Wellness Matters published the research online: "Just How Much Medical Care Do the Uninsured Use, and That Pays For It? - Insurance Agent in Jefferson GA."

The obligation of supplying insurance for employees can be an overwhelming and in some cases pricey job and several little organizations assume they can not manage it. What advantages or insurance do you legally need to give?

9 Simple Techniques For Auto Insurance Agent In Jefferson Ga

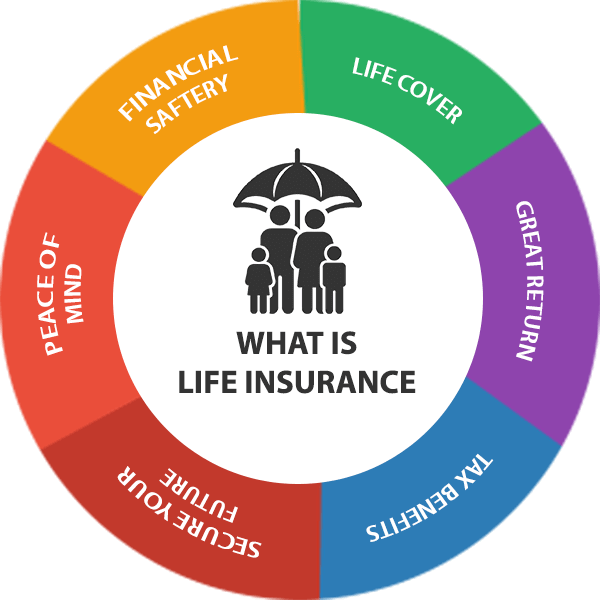

Staff member advantages usually start with health insurance policy and team term life insurance coverage. As component of the health insurance policy plan, a company might opt to provide both vision and dental insurance coverage.

With the climbing fad in the price of health and wellness insurance policy, it is reasonable to ask staff members to pay a portion of the coverage. A lot of companies do put most of the price on the employee when they supply accessibility to medical insurance. A retired life strategy (such as a 401k, SIMPLE plan, SEP) is usually offered as a staff member benefit.

Report this wiki page